![]()

If you are working on reaching some financial goals, this is the post that may be interesting to you. I am working with TransUnion, a web-based credit management offering products and sharing expert tips. Offering some powerful online tools and key information to help you reach your financial goals with TransUnion. It’s nice to know that it is one of the three major credit reporting agencies offering insight, protection, and assistance to get comfortable and maybe make that large purchase you have your eye on or to just get your credit score in better shape.

Reach Your Financial Goals with TransUnion

Let’s face it, money makes the world go round. Whether we want to give it that power or not, it exists. So easing some of that stress of getting your finances in order can be a bit of a challenge but with TransUnion’s credit tools for credit monitoring, as well as many other features highlighted below, the time may have come to gain some financial confidence and learn to budget like a boss to reach some life goals.

Why TransUnion?

TransUnion’s site offers options for both personal and business. With credit reports, assistance with identity theft and fraud, staying on top of and using the tools they offer, you can feel safe and protected when it comes to your credit. Take a look at some of the features TransUnion offers to their clients.

Credit Report Products

-

TransUnion Credit Protection

Defend against identity theft with Instant Alerts from TransUnion . We have all heard or have experienced fraudulent activity. Once it hits your credit report, can complicate your life and take years to correct.

When lenders request access to your report, TransUnion sends an alert by email to confirm. Anytime anyone tries to open a new credit card or get a car loan in your name, it’s possible to have the tools to stop the fraud before it goes too far. Extra credit protection with no extra cost.

-

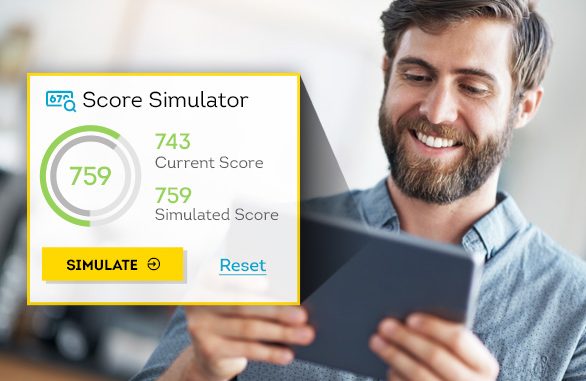

TransUnion Credit Score Simulator

Score Simulator through TransUnion shows ways to change current credit score based on future actions and events.

This is a pretty cool feature for it helps you take the guesswork out of credit score changes. Are you interested to know how your credit score would change based on future actions? It’s nice to know credit score stands, but also where it could go.

-

TransUnion Credit Lock

TransUnion can help prevent identity theft with Credit Lock. Identity thieves can destroy your credit and compromise your financial well-being. It may be easier than you think to safeguard your report.

Credit Lock is the latest tool in the fight against identity thieves with just a swipe or a click the credit report is locked. To unlock your report for a legitimate credit inquiry, just sign in to your account, unlock your report again with a swipe or a click. It is as easy as checking an email.

-

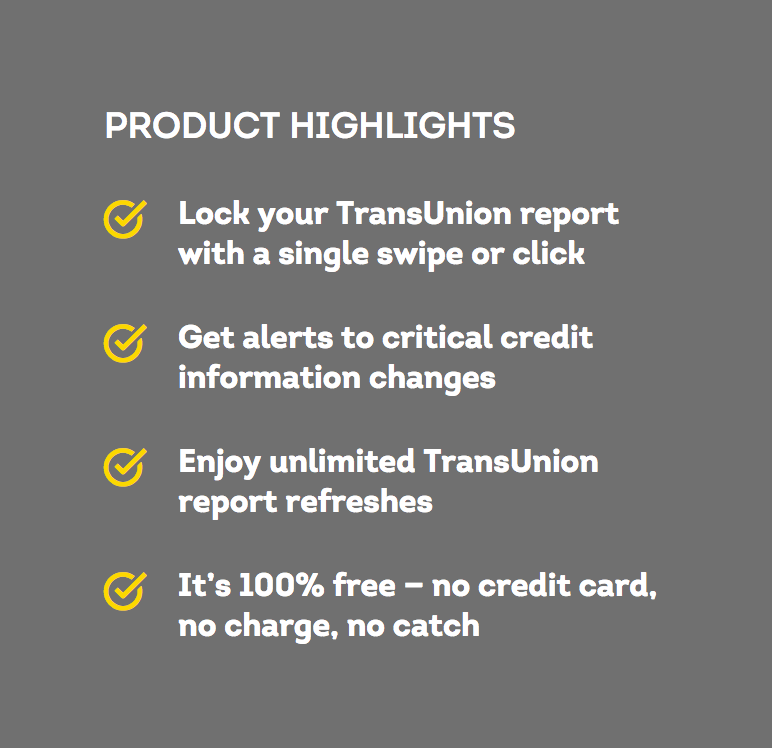

TrueIdentity Free Identity Protection

Get powerful identity protection in your hands now with TrueIdentity. It’s backed by TransUnion and completely free!

With TransUnion , your personal identity protection in the palm of your hand. TrueIdentity helps you stay in control with 1-Touch Credit Lock, informed with unlimited TransUnion Credit reports, and you can stay in the know of your credit with timely alerts.

Credit Education

You don’t need to go back to school to learn how to reach your financial goals! The Credit Education tab is full of information that is easy to understand and implement into your financial tracking.

-

Credit Score

TransUnion educates on what impacts your credit scores. It’s important to know how your credit score plays a crucial role in major life decisions, from auto financing, to buying a new home.

Learn how your credit score is calculated and what affects the score. Determining your score can be complicated when learning to weigh the different aspects of your credit history. TransUnion makes it easy to understand.

-

Identity Theft

Identity theft is a serious crime. Learn more about how to protect your personal information with easy tips for preventing identity theft, from locking your credit report to setting up better passwords.

With Identify Theft, a data breach occurs when personal information has been used or viewed by a person without appropriate authorization. Breaches can create serious personal and financial risk, so it’s important to understand how to protect yourself. TransUnion shows how they can occur for a number of reasons, including criminal activity, accidents, and even computer failures.

-

Debt and Money Management

TransUnion teaches how to develop management skills to create and maintain financial health. Control finances with useful tips for how to budget money, control debt management, create an emergency fund, and build a brighter financial future.

-

Credit Cards

Learn more about the different types of credit cards and how they can help you establish better credit for the future. Read more about how credit cards affect your credit rating. With our Featured Offers, find the card that best fits your lifestyle.

Credit Report Assistance

-

Credit Report Disputes

TransUnion teaches how to dispute inaccurate and fraudulent information on a credit report. If you have bad credit, there are credit card options for people who need to repair their credit. Secured credit cards are designed to provide people with poor credit histories to rebuild a positive line of credit. You can do it!

-

Fraud Alerts

If you suspect you have been the victim of fraud, TransUnion makes it easy to send alerts to your creditors and the other credit bureaus.

Credit Offers

Ready to give TransUnion a try? Check out their $9.95 monthly details.

-

- Get Credit Monitoring for ONLY $9.95/month PLUS Get a Free 3-Bureau Report and Scores!

- See your complete credit picture with your 3-Bureau Report With Scores (a $29.95 value!)

- Check TransUnion score & report changes 24/7 with UNLIMITED refreshes

- Lock thieves out of your TransUnion Credit Report with 1-touch Credit Lock

About TransUnion (NYSE: TRU) Information is a powerful thing. At TransUnion, we realize that. We are dedicated to finding innovative ways information can be used to help individuals make better and smarter decisions. We help uncover unique stories, trends, and insights behind each data point, using historical information as well as alternative data sources. This allows a variety of markets and businesses to better manage risk and consumers to better manage their credit, personal information and identity. Today, TransUnion has a global presence in more than 30 countries and a leading presence in several international markets across North America, Africa, Latin America and Asia. Through the power of information, TransUnion is working to build stronger economies and families and safer communities worldwide.

Follow TransUnion on Social Media

YouTube | Twitter | Pinterest | Facebook | TransUnion Blog

![]()

- You Have to Remember – 9/11, 20 Years Later - September 11, 2021

- Creating the Perfect Look with a Maxi Dress - October 20, 2020

- Brand Better Giveaway - October 6, 2020

Leave a Reply